Managing your finances wisely is crucial to achieving long-term stability and reaching your personal goals. Whether you’re saving for a major purchase, planning for retirement, or simply ensuring you can comfortably cover your monthly expenses, a well-structured budget is your first step towards financial empowerment.

Why Budget?

A budget does more than just track your spending. It helps you:

- Prioritize your needs over your wants, ensuring that essential expenses are always covered.

- Identify areas of excess spending that could be redirected towards more meaningful or necessary purposes.

- Build savings that protect you against unexpected emergencies and allow you to invest in your future.

- Reduce financial stress by providing a clear plan for where your money goes each month.

- Achieve your financial goals faster and more efficiently, whether that’s debt repayment, buying a home, or traveling the world.

Long-Term Impacts of Budgeting

Consistently following a budget can transform your financial situation. It helps in:

- Building wealth over time, as consistent savings grow through interest and investments.

- Improving credit scores by ensuring you have the funds to pay bills on time, every time.

- Gaining financial independence and freedom from living paycheck to paycheck.

- Enhancing decision-making skills as you become more attuned to assessing financial opportunities and risks.

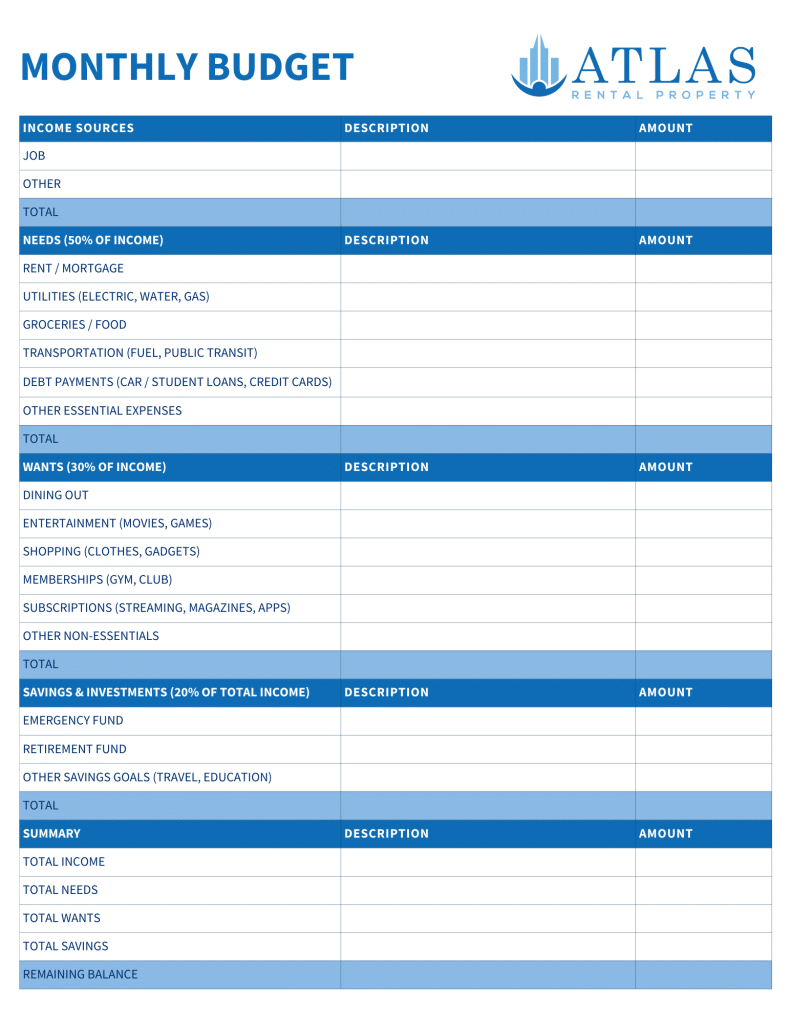

We’ve provided you with a simple budget template to get started. This tool is designed to help you manage your income effectively, ensuring that your needs are met while still enjoying life’s pleasures. Take a moment to fill it out each month, and you’ll soon see the benefits of a balanced financial plan.

Begin today—your future self will thank you! Download our budgeting template and get started.